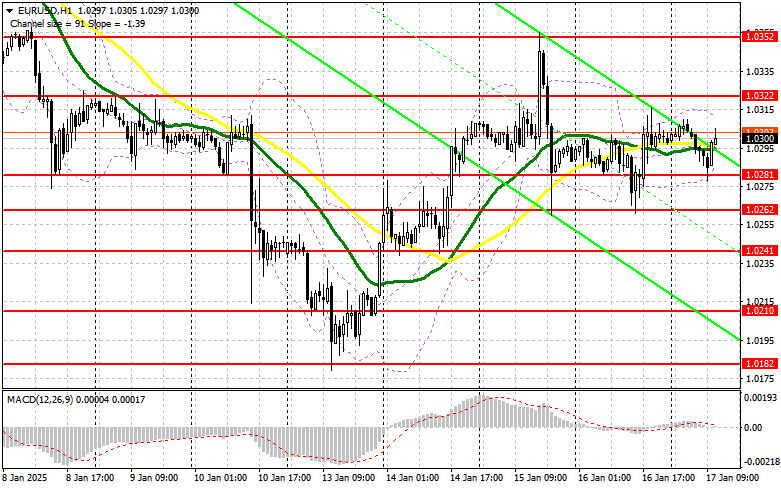

In my morning forecast, I focused on the 1.0287 level as a key point for market entry decisions. Let's analyze the 5-minute chart to see what happened. The price decline and the formation of a false breakout near 1.0287 provided a solid entry point for long positions, resulting in a 20-point rise at the time of writing. The technical picture has been revised for the second half of the day.

To Open Long Positions on EUR/USD:

Expectations of stable inflation in the eurozone prevented bears from pushing the euro below 1.0287, keeping trading within a sideways channel. Apart from inflation data expected later today, attention should also be directed to US fundamental statistics, which could further strengthen the euro. The US session features data on building permits, housing starts, and industrial production. Weak industrial production data could negatively impact the dollar, leading to further recovery in EUR/USD.

If strong statistics are released, pressure on the euro will return, and buyers will need to defend new support at 1.0281. A false breakout at this level would offer a good entry point for long positions, targeting resistance at 1.0322. Breaking and testing this range from above would confirm the validity of long positions, with a target of 1.0352. The ultimate goal would be the 1.0393 high, where I plan to take profits. If EUR/USD falls on the back of strong US statistics and shows no activity around 1.0281, selling pressure could increase toward the week's end, with bears aiming for 1.0261. A false breakout at this level could serve as another buying opportunity. I would consider long positions on a rebound from 1.0241, targeting a 30-35 point intraday upward correction.

To Open Short Positions on EUR/USD:

Sellers attempted to pressure the euro but lacked support from major players, likely waiting for more significant data. If the pair rises after the data release, a false breakout near 1.0322 would confirm the presence of large players in the market and provide a good entry point for short positions. The target would be support at 1.0281, where I expect active buyer interest similar to what was observed earlier. A breakout and retest of this range from below would present another selling opportunity, targeting the 1.0262 low—the lower boundary of the sideways channel. The ultimate goal would be the 1.0241 level, where I would lock in profits.

If EUR/USD rises in the second half of the day and bears fail to act at 1.0322, I would delay short positions until the next resistance at 1.0352—the weekly high. Shorts can be considered there, but only after an unsuccessful consolidation. Alternatively, I would sell immediately on a rebound from 1.0393, aiming for a 30-35 point downward correction.

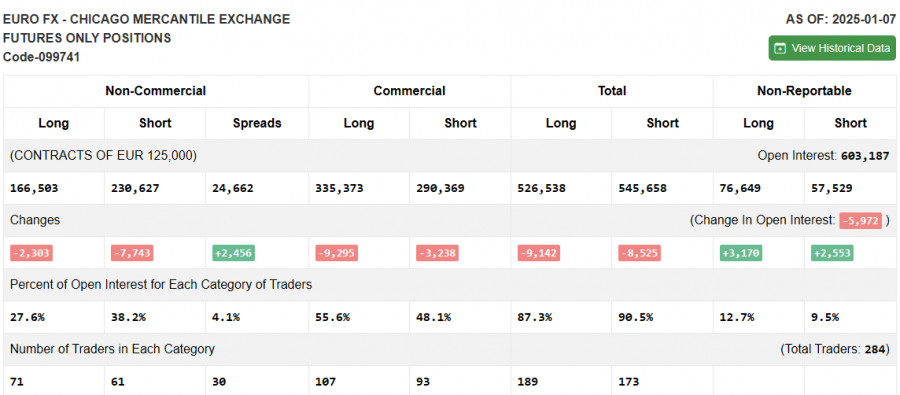

According to the Commitments of Traders (COT) report for January 7, both short and long positions declined. Given that the Federal Reserve's rate cuts are now expected in the fall, the US dollar remains strong in the medium term. If upcoming data on US inflation and GDP shows growth, it would further justify adding long positions on the dollar. The COT report shows that long non-commercial positions decreased by 2,303 to 166,503, while short positions fell by 7,743 to 230,627, widening the net position by 2,456.

Indicator Signals

Moving Averages

Trading is near the 30- and 50-day moving averages, indicating market uncertainty.

Note: The moving averages are based on the H1 chart as analyzed by the author, differing from the standard daily averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator around 1.0281 will act as support.

Indicator Descriptions:

- Moving average (SMA): Determines current trends by smoothing volatility and noise.

- 50-period: Marked in yellow.

- 30-period: Marked in green.

- MACD (Moving Average Convergence Divergence): Measures convergence/divergence of moving averages.

- Fast EMA: 12-period.

- Slow EMA: 26-period.

- SMA: 9-period.

- Bollinger Bands: Measures volatility with a 20-period moving average and standard deviation.

- Non-commercial traders: Include speculators such as individual traders, hedge funds, and large institutions trading futures for speculative purposes and meeting specific criteria.

- Long non-commercial positions: Total open long positions held by non-commercial traders.

- Short non-commercial positions: Total open short positions held by non-commercial traders.

- Net non-commercial position: Difference between long and short positions of non-commercial traders.