U.S. stock index futures tumbled Thursday as investors took advantage of the technical failure of the instrument's inability to break above $4,480 after digesting corporate profit and loss reports, Federal Reserve news, and developments in the Russian-Ukrainian conflict. Futures for the Dow Jones Industrial Average lost 161 points, or 0.46%. S&P 500 futures were down 0.5% and Nasdaq 100 futures were down 0.63%.

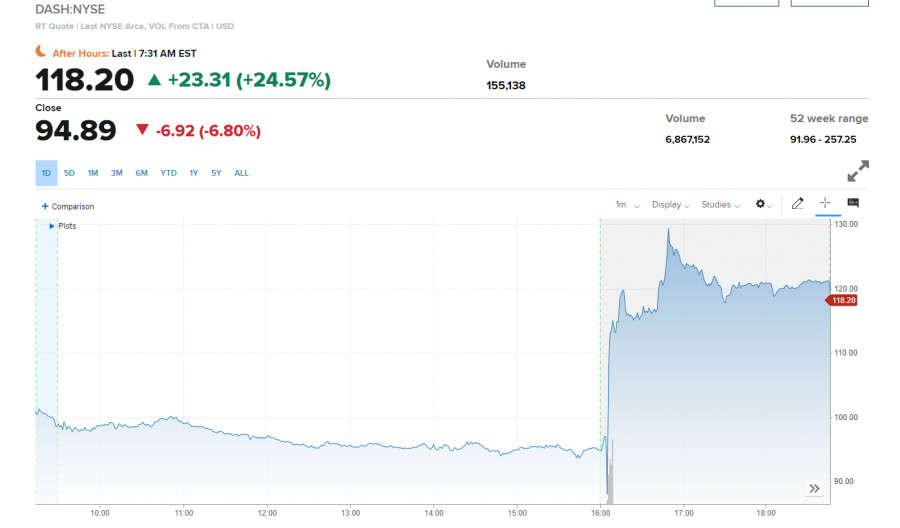

Yesterday, quite a lot of corporate reports were published, which indirectly only influenced the direction of the market. DoorDash rose more than 26% today in premarket trading after the company announced revenue growth and issued an upbeat outlook. Cisco rose 3.5% after the company raised its forecast and Applied Materials added 2%. Today, investors are waiting for quarterly reports from Walmart, Airbus, Autonation, and Nestle.

Attention should be paid today to weekly data on jobless claims in the U.S. Economists estimate that claims for benefits could reach 218,000, a slight drop from the previous week. The market will also see data on the number of new homes and building permits, as well as the manufacturing index of the Philadelphia Fed. Fed spokesman James Bullard's speech may affect market volatility.

As of yesterday, the S&P 500 was almost unchanged at the close of the trading session on Wednesday, while the Dow lost almost 55 points and the Nasdaq Composite shed 0.1%.

Buy gold

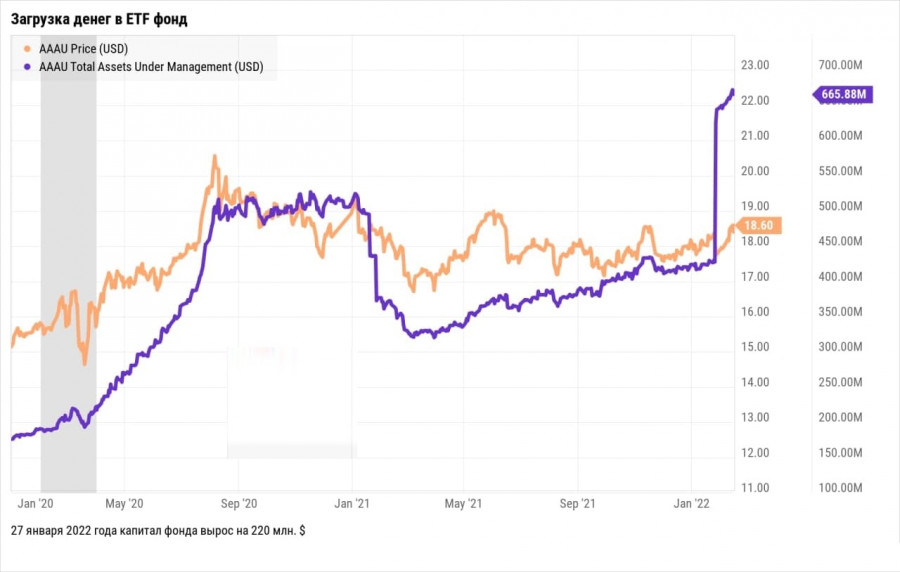

The ongoing tension on the Russian-Ukrainian border continues to influence the mood of market participants, which is confirmed by the growth of gold. Recently, this trading tool has grown significantly, and the recent correction has only increased demand for it.

Goldman Sachs Physical Gold ETF (AAAU), which fund holds physical gold in Australia, began to actively grow capital. Recently, the fund's AUM has grown by $220 million. Investors continue to gain positions in gold, as they do not believe in a quick end to the conflict between Russia and Ukraine.

NATO officials on Wednesday accused Russia of increasing the number of troops on the border of Ukraine. On Thursday, Russia has expressed dissatisfaction with the unrest in eastern Ukraine and warned that now it will take time to withdraw troops from the border. According to the latest data, the People's Militia of the LPR reported shelling from the Ukrainian side. The DPR military returned fire. The police of the unrecognized republic declare that the ceasefire regime was violated four times in a day, a total of 42 shells came from the Armed Forces of Ukraine.

International investors pour more money into Chinese stocks

Leaving aside geopolitics, it is worth noting that investors continue to look towards China. Mainland China equity funds saw a net inflow of $16.6 billion in January, according to research firm EPFR Global. The data showed that the gain followed a net inflow of nearly $11 billion in December. The mixed interest comes as global investment firms have become more positive about mainland Chinese equities in the past few months.

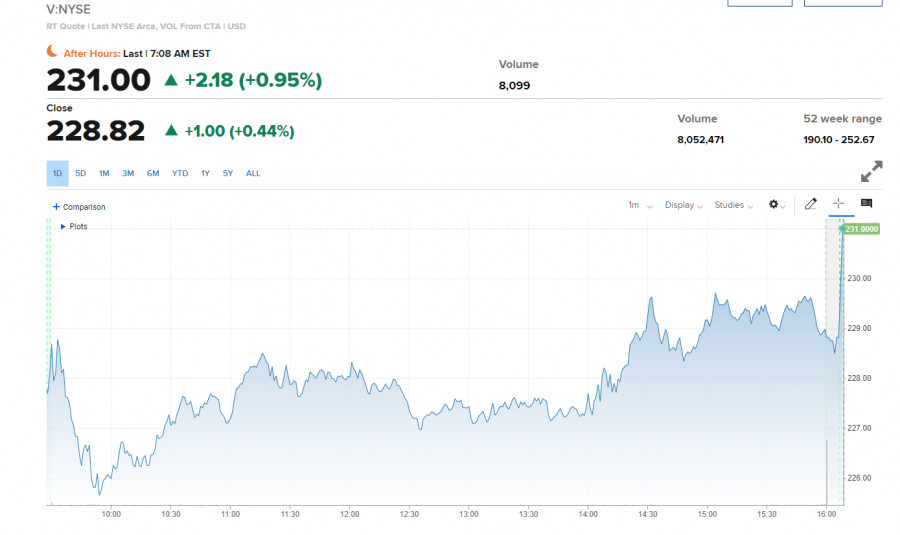

Amazon and Visa

Finally, Amazon has reached a global agreement with Visa to settle the dispute over credit card fees. The deal means that Amazon customers in the UK can continue to use Visa credit cards, as previously announced by both companies. Amazon will also cut the 0.5% fee on Visa credit card transactions in Singapore and Australia, which it introduced last year. Last month, Amazon said it had abandoned plans to stop accepting Visa credit cards in the UK. The company noted that they will continue negotiations on a broader resolution of their spat.

Against this backdrop, Amazon did not react to the news in premarket trading and added 0.41%, trading at $3,175. Visa rose from 228 to 231 +1.0% in premarket trading.

As for the technical picture of the S&P 500

The bulls rested at $4,488, while forming a powerful support at $4,433. The further direction will depend on going beyond these levels. In case of a return under $4,433, it will be necessary to think again about protecting the support of $4,378. A breakdown of $4,378 will increase pressure on the index and return the bear market with the prospect of updating lows at $4,312 and $4,265. Surely the bulls will try to continue moving up today in the $4,488 high area. A breakdown of this area will keep the bull market alive and bring trading back to the $4,539 major resistance.