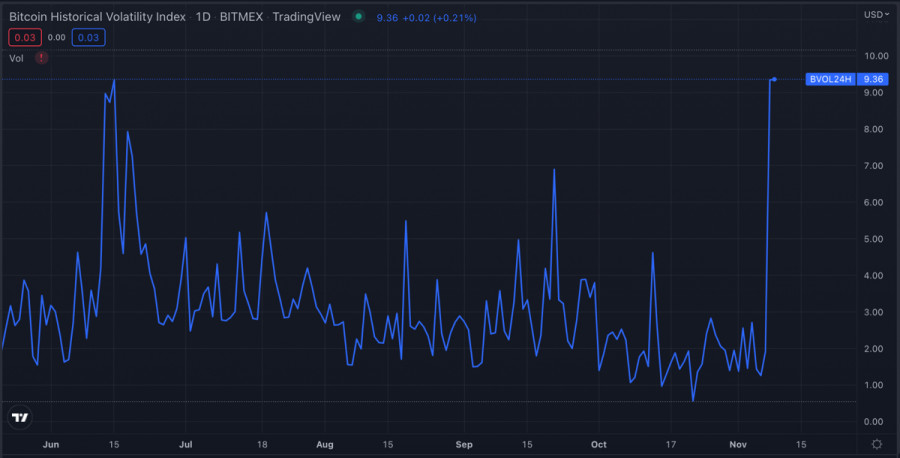

Over the past month, theses have repeatedly appeared in the crypto space that Bitcoin has become less volatile than stock indices. However, the events of November 7–8 showed that the stability of an asset or market lies not only in a permanent stabilization movement, but also in the corresponding behavior of players during resonant events.

Following the results of November 8, Bitcoin updated the local bottom, making a bearish breakout of the $17.6k level. At the moment, the asset price reached $17.1k, and even a sharp activation of buyers did not help Bitcoin recover at least above $19k.

Over the past day, BTC/USD quotes have fallen by 8%; the weekly drop has reached 11%. A similar situation is observed on other cryptocurrencies, and the total capitalization has fallen to the $890 billion level. Given the long consolidation period, some assets managed to build up "muscles," which did not allow the market cap to fall to the previous minimum.

Reasons for the fall of BTC/USD

Friction between FTX and Binance served as an important trigger for the sharp drop in Bitcoin quotes and the update of the local bottom. The conflict situation, which can be confidently called a takeover attack, was resolved a few hours before the collapse of the crypto market.

The situation can be compared to the collapse of Terra, given the venerability and assets of both players. Despite Binance's direct involvement in the conflict, we don't see a massive sell-off of billions of dollars of assets thanks to a deal to buy FTX.

The decline of BTC to $17k accelerated due to significant negative factors in the crypto market. However, don't forget that huge amounts of liquidity were accumulated below the level of the previous local bottom. In the near future, we expect a long consolidation and trading of the $17k–$19.2k range.

Results

The fundamental nature of what happened highlights the complete break in the correlation between Bitcoin and stock indices. The S&P 500 continued its upward movement amid the collapse of the crypto market. At the same time, the US dollar index continued its correction and again tested the support level of 110.

For the cryptocurrency market, the situation has worsened as the period of temporary thaw has ended. The collapse of one of the largest crypto exchanges plunged the market into fear, which means a massive outflow of liquidity and a new wave of bankruptcies.

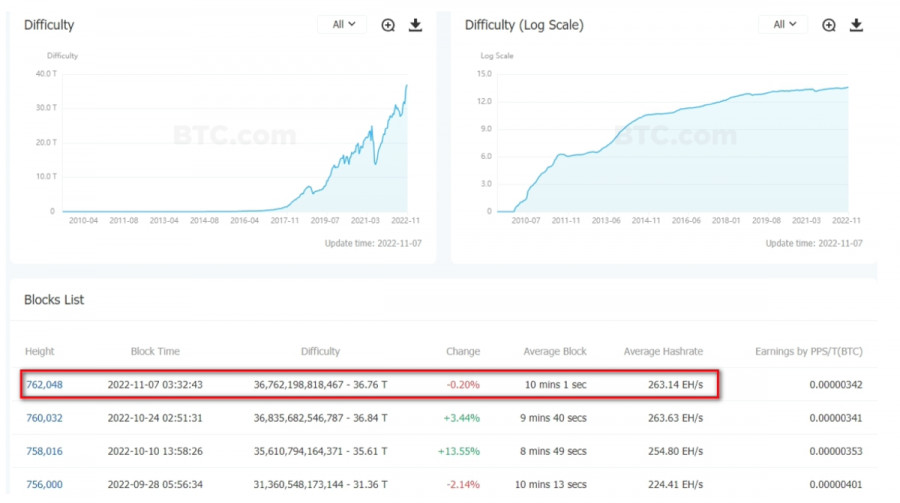

The main contenders for elimination from the race will be public mining companies. In addition to the difficult liquidity situation, the difficulty of mining BTC continues to increase, and according to the ratio of mining difficulty to price, the cryptocurrency is significantly undervalued.

It is also important to note that the upcoming ban on mining in Europe due to the electricity crisis will have a painful impact on the position of the miners. Given this, it is the mining industry that will suffer mainly.

BTC/USD Analysis

After the events of recent days, there is no doubt that Bitcoin made a false breakout of the $20.4k–$20.8k resistance zone. The asset had enough strength to hold the $20k level over the weekend. However, we did not see an increase in on-chain indicators, which was the reason for the gradual decline in the price of the asset.

A period of stabilization and consolidation will begin in the coming weeks. The $19.2k level looks like the top of Bitcoin's bullish efforts, and therefore the area below $19k will be most actively traded. It makes no sense to consider technical metrics and on-chain indicators since the market is in shock.

Results

The formation of the second local bottom of Bitcoin occurred due to a negative event comparable in scale to the collapse of Terra. At the same time, we did not see a decent response from buyers, which indicates that the market is in total fear, which is aggravated by the liquidity crisis.

In the coming weeks, we should expect a lull in the crypto market, an outflow of capital and probably, aggravation of liquidity problems for a number of public companies. The update of the local bottom is an important signal for the gradual end of the bear market, but there is every reason to believe that the current fall will not be the last.